At CES, tech alliances firm up in the self-driving car wars

Important automakers like Common Motors, Ford and Volvo deepened ties with essential technologies companions this week to gird for the combat from electrical motor vehicle challenger Tesla Inc and Apple Inc as it revs up to enter the marketplace.

3 chip corporations – Intel Corp’s Mobileye, Qualcomm and Nvidia – have emerged from a raft of announcements at the Client Electronics Clearly show in Las Vegas as the leaders in locking down the brains of self-driving cars for the next 10 years.

The specials entail consolidating scores of more mature, slower chips into a lot more powerful centralized desktops. But to win them, the chip corporations have experienced to consent to letting automakers management essential components of the technologies.

Reuters has earlier noted that Apple plans an electrical motor vehicle. Bloomberg noted past year that the Apple iphone maker is aiming for total self-driving abilities as early as 2025.

For automakers struggling with Apple and Tesla, the stakes are large. In addition to electrifying their versions, automakers are basically creating desktops with expanding self-driving abilities.

That indicates a major option for automakers to make revenue off computer software and companies in cars lengthy immediately after vehicles roll off a dealer’s great deal, but only if they can hold the shopper associations and info for on their own, the way that Tesla and Apple do.

Automakers “that haven’t been the pioneers are last but not least acknowledging they are heading to be left in the dust if they will not change their strategy,” reported Danny Shapiro, vice president, automotive for Nvidia, a maker of large-run chips.

Nvidia this week introduced specials to provide the electronic brains for long term versions from a number of Chinese electrical motor vehicle startups, and is working with other automakers like Mercedes, Hyundai Motor Co, Volvo and Audi .

Control of technologies and info are spots of rigidity concerning automakers and technologies companies, Shapiro reported. “Control and customization, and who owns the info?”

The remedy is advanced due to the fact of the staggering quantity of technologies expected to make cars travel on their own.

These involve computer system vision algorithms to support cameras figure out pedestrians, sprawling large-definition maps of the world’s streets, and “travel plan” computer software to make millisecond conclusions about how the motor vehicle should really behave when confronted with the surprising.

For chipmakers, this indicates they want to have just about every aspect of the technologies prepared, but be prepared to enable consumers select and opt for.

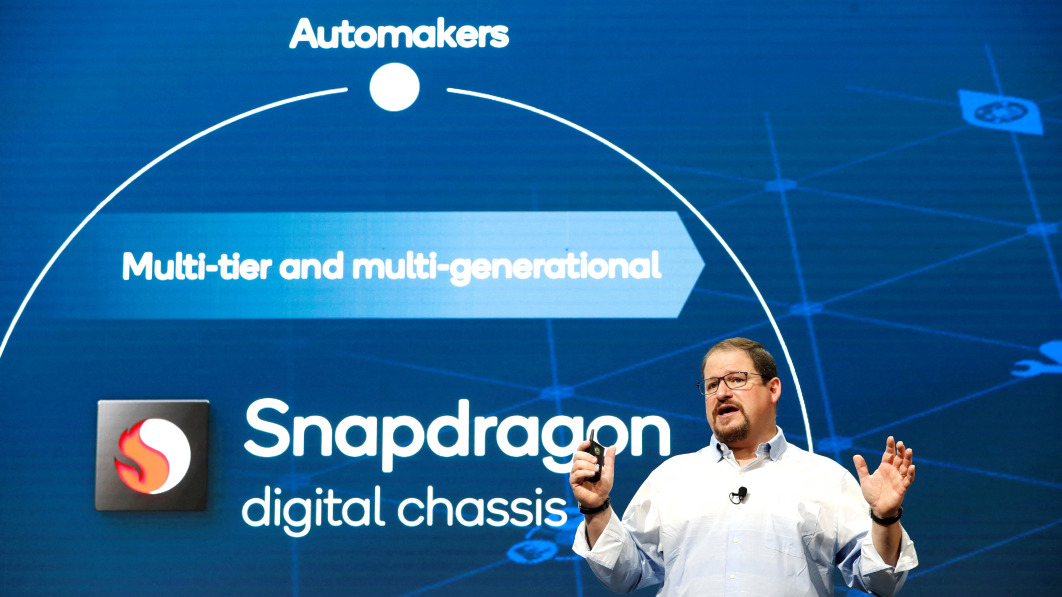

Qualcomm Inc, for instance, expended $4.5 billion past year to obtain Veoneer Inc to round out all the items of computer software desired to enhance its self-driving motor vehicle chips. But immediately after winning its very first significant self-driving chip contract with GM this week, these computer software property will not be provided due to the fact GM has its have.

“Our computer software stack is all internally developed. So we’re not getting their items,” reported Jason Ditman, main engineer for GM’s forthcoming “Extremely Cruise” arms-free of charge driving products.

But for other carmakers, Qualcomm requirements to have all the items of a self-driving method prepared, reported Nakul Duggal, senior vice president and standard manager of automotive at the chip agency.

“Different automakers come across on their own at distinctive points of readiness,” he reported. “What is significant for the automaker is that they have to be able to develop a romance with the shopper that they are striving to get.”

A equivalent dynamic is at engage in in Mobileye’s romance with Ford, which was deepened this week. Mobileye utilized to provide its digital camera, chip and self-driving computer software as an all-in-a single products. Now Mobileye will start off separating out some of its system’s functions and permitting Ford to develop its have technologies on prime of them.

“We deliver all the outputs to Ford, and they’re going to run their have algorithms on prime of our outputs,” Mobileye Main Govt Amnon Shashua informed Reuters.

The chip companies have very little selection but to be a lot more adaptable as they experience significant competitors of their have.

Automakers experienced relied on three primary suppliers for the less complicated semiconductors that managed combustion engines – Infineon, Renesas and NXP, reported Phil Amsrud, a senior principal analyst with IHS Markit.

But the marketplace of chip corporations giving large-run computing to motor vehicle makers is comparatively crowded, like Chinese companies this kind of as Huawei Systems Co Ltd and computer system vision business Ambarella Inc going into the car sector.

“We’re at a position the place we may be getting way too many suppliers,” Amsrud reported. “If you seem at automotive typically there is certainly hardly ever been a lot more than a handful.”

(Reporting by Stephen Nellis in San Francisco and Joseph White in Detroit Enhancing by Richard Chang)