Auto sector fears higher GST rate on certain parts after Supreme Court ruling, Auto News, ET Auto

Many auto and automobile part organizations have approached the federal government soon after the oblique tax department initiated enquiries to tax sure components at a bigger price underneath the products and expert services tax framework (GST).

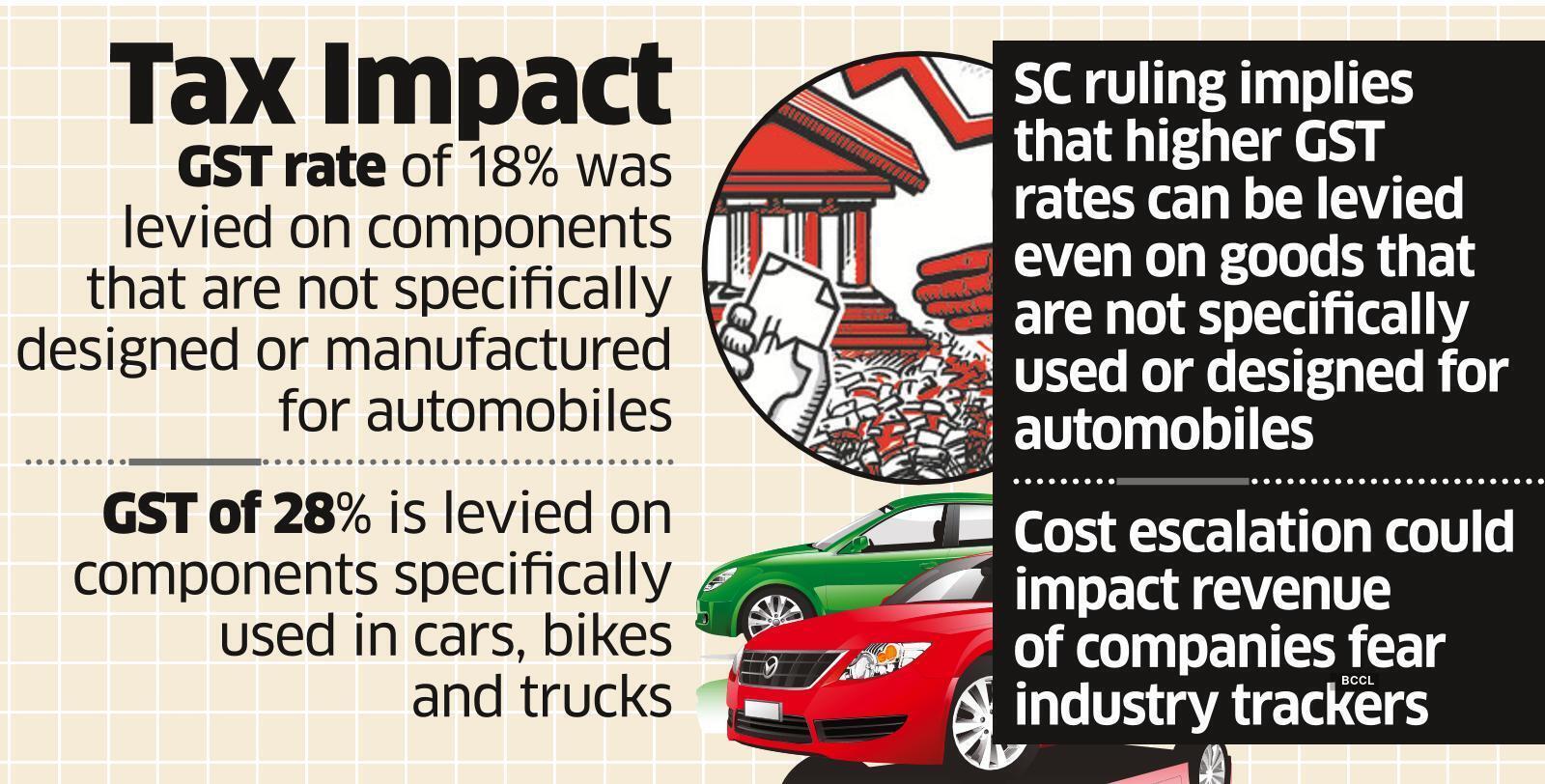

Their worry is that the oblique tax department could now slap 28{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade} GST on these components rather of 18{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade}, pursuing a Supreme Court ruling.

The ruling, in an fully distinct matter, mentioned that GST prices can vary dependent on “sole and principal” use check.

The GST framework is a nuanced tax process that categorises and defines each merchandise, merchandise and then decides the tax prices.

Underneath chapters 86, 87, 88 and 89 of the framework, many automobile components are outlined, and these are taxed at 28{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade}.

Apart from these, there are components that are not outlined, as they have multiple makes use of, apart from currently being made use of in cars and bikes, and these are taxed at 18{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade}.

Subsequent the SC ruling, even the ones that are taxed at 18{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade}, will be taxed at 28{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade} underneath the GST framework, say tax experts.

Quite a few domestic suppliers as perfectly as importers would now be required to cough up bigger taxes. In most instances, organizations are nevertheless having to pay the old taxes, but the tax department’s inquiries would signify a dispute and litigation heading ahead, warn authorized experts.

“Supreme Court ruling has negatively impacted the auto sector, resulting in advantages for railways and airlines,” mentioned Rohit Jain, associate at law business ELP.