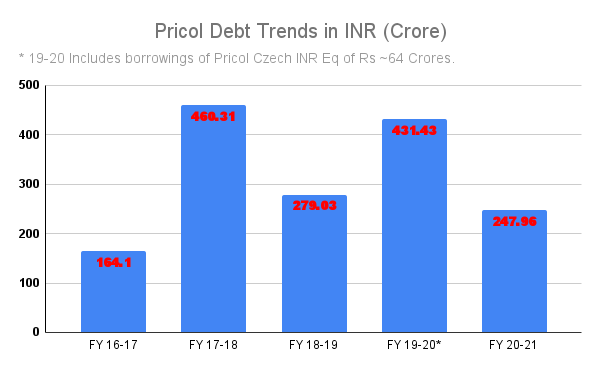

The company’s complete financial debt stood at INR 247 crore in FY21 which arrived down from INR 431 crore in FY20.

When Vikram took over the reins in 2011 from his father as the Managing Director, the organization was going through just one of its worst phases. Over the past 5 yrs, he has wholly restructured the organization and place it on a recovery path.

Nevertheless, Vikram said even though the company’s capacity utilization is still reduced, it is producing a excellent volume of absolutely free hard cash and “our aim in the upcoming twelve months is to turn out to be financial debt-absolutely free even at this lower concentrations of production and demand from the market”. The organization remained off the targeted earnings mark of INR 2000 crore from the auto company in 2021.

In March this yr the ranking company ICRA upgraded the ranking for Pricol Confined to [ICRA]BBB(Stable)/[ICRA]A3+ from [ICRA]BB+(Stable)/ [ICRA]A4+.

Nevertheless, ICRA said, “The organization (Pricol) expects some maximize in financial debt concentrations going forward from the December 2020 concentrations due to the fact of the incremental doing the job funds demands following a reduction in lenders in Q4 FY21. Even so, it is envisioned to be drastically lower than March 31, 2020 concentrations. With predicted healthful accruals and absence of financial debt-funded CAPEX, ICRA expects Pricol’s consolidated coverage metrics to stay healthful over the medium expression.”

Another stage of worry is that Pricol proceeds to derive 70% of its revenues from the 2W phase, and fifty seven% from its prime a few consumers. Additional, over 90% of the earnings is from the domestic sector. In the past a few yrs, two-wheeler production has occur down to fifteen.132 million in FY21 from over 21 million in FY19. To de-possibility alone, the organization is on the lookout at diversifying through new joint ventures (JVs).

New JVs and products diversification

As the chip shortage and demand disaster grip the industry, Pricol shifts its technique and beefs up the products line with fewer dependence on semiconductors. It is also entering the export markets.

Pricol had pretty much zero export till a several yrs ago but now it is little by little attempting to establish up the abroad company.

“We have began developing products for export not dependent on the chip. They incorporate the complicated geometry pumps for oil, fuel and h2o, for stationary engines, heavy automobiles, building machines, and for consumers like Caterpillar, Polaris, Polar, Generac, etc. Demand from customers for them is now choosing up and we have verified contracts and those initiatives are bit by bit setting up up volumes,” Vikram said, incorporating that he sees deemed export is increasing drastically and in the upcoming two to a few yrs it will also improve the base line.

The organization will get sixty% of earnings from driver details method (DIS) and claims that it is the second-major DIS participant in the two-wheeler sector globally by volume and the fourth major for commercial and off-road automobiles.

We are on the lookout at a JV in the wiping devices to broaden this companyVikram Mohan, Managing Director, Pricol Confined

Also as a portion of the physical exercise, over the upcoming several months, the organization will be announcing a sequence of technological know-how partnerships in HMI, in advanced car details devices etc. It lately announced a tie-up with an American organization identified as Candra Systems.

“All of these partnerships will assist us be between the direct players in DIS in certain parts of 2-wheelers and commercial automobiles and that we have a really significant sector share and a world wide leadership position,” he educated.

“Our pumps vertical is expanding both equally organically and on the lookout for possibilities for inorganic growth. We also have programs to get into newer parts like coolant pumps, etc. for which we have tied up for technological know-how. In the wiping devices, we are on the lookout at growth through a joint venture,” he said.

“We are also talking to at minimum two world wide majors the place we will be announcing JV businesses. It could be forty nine:51 or 50:50 or 26:seventy four also in the upcoming 6 to twelve months to get into new products strains and also to increase choices in the sensing room in the car – the numerous digital sensors that are coming in the car in the future,” Vikram said.

New investments

About new investments Vikram said, “It is also early to discuss investment programs. Almost certainly in three to 5 months, I will be in a position to remark on this as it is still under wraps. But just one of them is absolutely going into the automotive sensing room the place we are finding more and more into digital sensors.”

Nowadays there are pretty much 120 sensors in a car and a car is going to get driven more and more by numerous sensors feeding in and driving the car.

Vikram declined to remark on the products line details of the second JV, but he educated that this is an OEM-driven challenge. In reality, OEMs want them to get into company.

Both equally the JVs are going to be with overseas collaborators but mainly to support the Indian Sector to get started withVikram Mohan, Managing Director, Pricol Confined

Both equally the JVs are going to be with overseas collaborators but largely to support the Indian sector to get started with. “We are on the lookout at just one JV with an Asian organization and just one with a European organization,” Vikram educated.

The organization is also attempting to beef up exports. “We have began off in the room of the pump, doing the job with stationary engines and off-road car markets that will go to about INR four hundred crore in the upcoming a few yrs. It will be a considerable part of our revenues going forward contributing to at minimum 25% of our base line. And that is a really very clear technique that we have to hold raising our exports from a mere zero a several yrs ago,” he said.

Concentration on R&D can help improve EBITDA

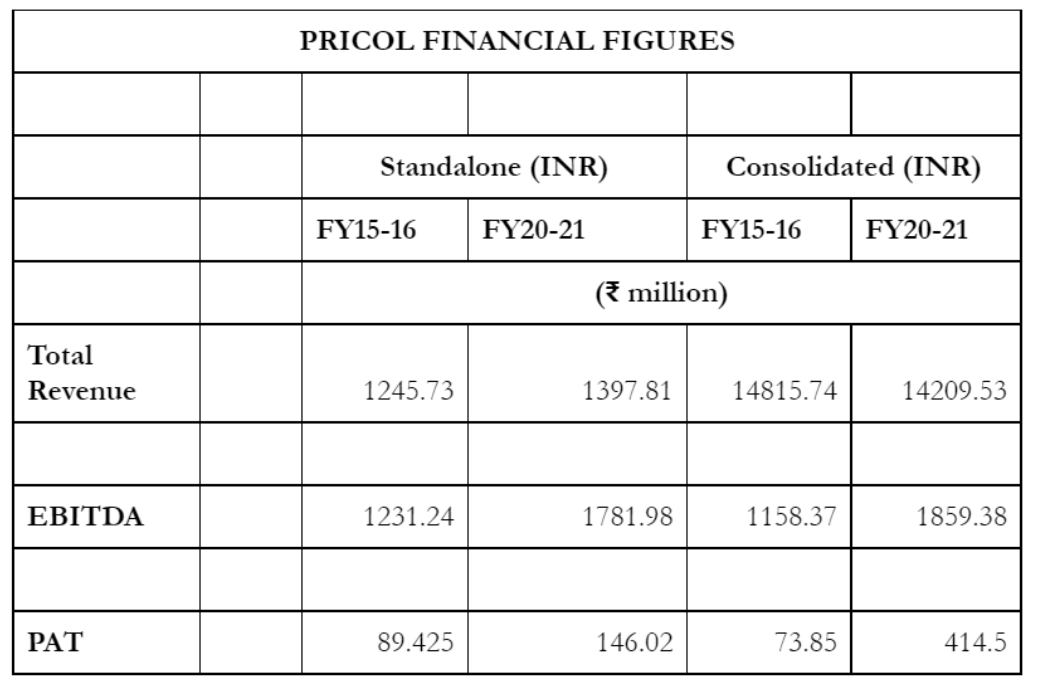

Pricol is getting more of a technological know-how participant than a element company. Whilst the average expenditure of the Indian automotive industry on R&D is about 2% to 2.5% of earnings, Pricol has taken a conscious call in the past 5 yrs to invest wherever amongst four.5% and 5% of earnings on both equally products and approach technological know-how.

“As portion of relocating up the value chain, out of the 800 white-collar staff, about three hundred perform in the R&D section,” Vikram said.

“This aim has resulted in aiding us improve EBITDA and expenditures and also develop a slew of new products that have amplified earnings and runway of products,” he additional.

So, the invest on R&D, both equally products and approach technological know-how, will go on to be at all around four.5% of earnings both equally for this economic yr and for the upcoming. Whilst CAPEX is going to be in the vicinity of-zero.

I think Q3 of FY22 is most likely going to be the worst quarter for the automotive industryVikram Mohan, Managing Director, Pricol Confined

The organization feels relieved as it is on a CAPEX light-weight mode or a sustenance CAPEX design for the economic yrs 2021, 22, and 23. Nevertheless, it additional two new vegetation and the capacity of numerous of the current vegetation owing to the amplified demand in company and for the new products that it released.

“It will be more material sustenance Capex and no considerable Capex to maximize prime line. We do have programs for a different considerable spherical of Capex in FY24 to cater to some newer products and demand that we are anticipating at that stage of time,” he said.

Vikram further more additional that the demand forecast is down by at minimum thirty% and in the very same line the organization expects a fall by thirty% in its turnover in comparison to envisioned product sales of INR 1850 crore for this yr.

“So, at a capacity utilization stage, we are at about sixty% right now. And with the modifying products-blend we have a capacity and the runway and verified orders of company to take us to about INR 2200 crore to INR 2400 crore” he said.

Worst is yet to occur for the industry

The offer chain disaster arising from chip shortage will worsen in the third quarter of the economic yr 2021-22 Vikram said.

“I think the dilemma is reaching its peak and Q2, the quarter that has just closed, and Q3 of the latest economic yr FY22 would most likely be the worst quarters for the automotive industry. This will come when the businesses in China are reducing back again production due to the fact of the electricity disaster,” he advised ETAuto in an exclusive interview.

The industry is going to see the worst quarters quite possibly in the automotive industry so far, barring the first quarter of the past economic yr which was a washout for most businesses, Vikram said.

He believes that from January 2022, there will be some diploma of aid and normalcy is very likely to occur back again to the automotive sector in September or October 2022 and not before.

We don’t aim on the PLI plan, we will mature our company independentlyVikram Mohan, Managing Director, Pricol Confined

About the lately-released Generation Joined Incentive (PLI) for the auto sector, Vikram said “We are not genuinely targeted on the PLI plan due to the fact our company programs are unbiased and we are not setting up our company case based mostly on any federal government subsidies.”

He emphasized that the industry is relocating up in the technological know-how curve. For example, 10 yrs ago, the average price of a DIS, which was identified as an instrumental cluster in those times, was about INR three hundred, and these days it has jumped to INR a thousand for a two-wheeler. In the upcoming two yrs, it is going to turn out to be closer to INR 1800 and we are also developing much more complicated DIS devices.

“We are targeted more on tech and fewer on the products due to the fact technological know-how disruption is so speedy in electronics, not just in electric automobiles and electronics for every se, and that is our aim spot,” Vikram additional.

Also Read through:

More Stories

Top 5 Family Cars to Lease with Bad Credit in the UK (2024)

Porsche Cayman R (987) | Spotted

Win a pair of tickets to Race Retro 2023