Putting EV at forefront, Indian auto inc proposes USD 13 bn investment in 2021, Auto News, ET Auto

Right before the worldwide pandemic struck, auto OEMs were accustomed to steady funds improves as engineering transformed company processes, designs, and methods. COVID-19 fully modified their method to engineering, foreseeable future mobility and corresponding investments.

The pandemic also exposed the important provide chain weaknesses, including need surges and drops, commodity shortages, diminished productiveness, delivery delays and storage and product handling challenges. For that reason, COVID-19 turned an eye-opener for the adoption of resilient in-house provide chain and administration remedies. And so, the stakeholders of the automotive industry rushed to make neighborhood preparations.

“In 2021 a great deal of investments have long gone into digitisation throughout the value chain. A important element of the investments was on product growth for electrical motor vehicles and tweaking the production setup appropriately. Investments have also long gone into the growth cycles of the products and solutions for the forthcoming security and emission regulations,” Ashim Sharma, partner and group head – company functionality advancement consulting, Nomura Research Institute, said.

In a 12 months of market oscillation, auto OEMs recorded USD 13 billion (~INR 99,000 crore) financial commitment in India throughout all offer styles, the most well known remaining for electrical mobility. Combining equally the legacy gamers and the startups, practically 50 percent of the gross investments (~ INR 48,four hundred crore) was on electrical architecture growth.

When OEMs and startups focused a lot more on electrical and foreseeable future mobility in the short-to-medium expression, suppliers used a lot more on technological upgrades and software resources.

Right after a time period of pandemic-induced slowdown that resulted in subdued expending, market watchers say that purchaser sentiments commenced looking up from January, 2021. This prompted organization leaders to expedite expending.

For the duration of this time period, automotive industries also witnessed disruption in the provide chain of microchips. This crisis carries on, and an unavoidable issue ought to be elevated on whether the semiconductor crunch will impact or reverse the R&D and the tech expending methods in the coming months.

Listed here are some developments that drove the program of investments this 12 months:

Investments bought electrified: Investing toward foreseeable future-mobility systems ongoing all over the pandemic. Research demonstrates that about 48% (~INR 48,four hundred crore) of the full investments was in eco-friendly and foreseeable future mobility and similar infrastructure growth, particularly in the aftermath of the COVID crisis.

This is thanks to the substantial variety of battery-operated electrical propulsion engineering developments and method integration all over automation, connectivity, electrification, and wise mobility (ACES) features. Out of ACES, e-mobility has emerged as the most important feature of financial commitment in accordance to ETAuto Research, notably all over battery engineering and administration programs, e-motors, and power electronics.

Electrification also bought a important enhance with the advent of new age corporations. About 90% of startups in the auto industry are operating and creating products and solutions similar to EVs.

This, however, draws a sharp contrast to the early times of 2020 when e-mobility room was highlighted as just one of the most negatively impacted areas thanks to COVID-19.

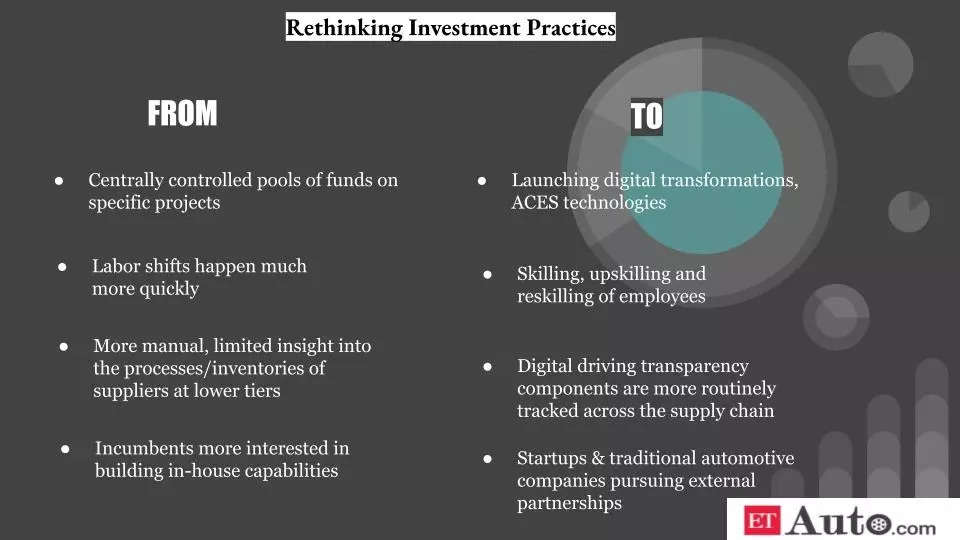

Application was at the main: While corporations produced sizeable cuts in expending in practically every classification, there were increasing engineering budgets for most of the automakers (OEMs) and tier-one suppliers. In the R&D areas of expending, corporations have been allocating sizeable budgets on software and software-similar feature growth. Over-all, the financial commitment trend highlights that the emphasis has been shifting in the automotive industry, equally from the OEM and the supplier perspectives. Stakeholders have been putting software growth at the forefront thanks to its crucial part in the car of the foreseeable future.

Motor vehicle navigation software, multi-running infotainment programs, crafted-in cybersecurity and autonomous ADAS remedies have been among the the emphasis areas drawing the attention of the automakers.

Automation is a further spot the place corporations diverted their software funds. Workforce shortages essential organisations to appear for prospects to automate processes, shop floors and to lessen human involvement.

Startups produced a mark: The non-incumbents, in accordance to the Research, have produced in excess of INR fifteen,615 crore of investments on foreseeable future-mobility in the last twelve months. However the quantum is smaller, the startup group rallied to fight the Coronavirus crisis in the very best way it knew—with improvements and up-to-date systems. These enterprise money-backed newcomers were the ones who responded to the crisis with the speedy adoption of digital systems.

While current volumes are limited, EVs are expected to improve in a large way. With the government emphasis on eco-friendly mobility, it is acceptable to count on the influx of startups in this spot and they type in excess of 32% of investments in this room.

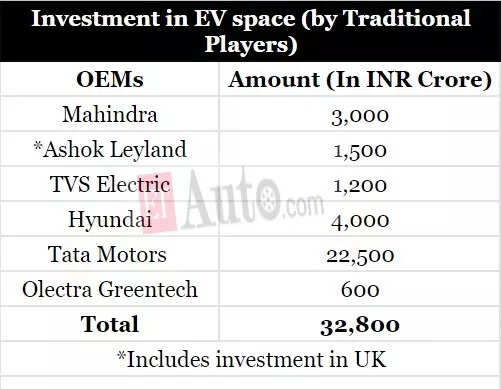

Comparatively, classic automotive corporations accounted for sixty seven.7%, or approximately INR 32,800 crore of the full financial commitment on electrical mobility this 12 months.

Provide-chain disruption pushed in-house abilities: A a lot more perceptible impact of the pandemic has been on the provide chain entrance. Provide chain concerns were radical not only mainly because of COVID-19 but also mainly because of geopolitical tensions, microchip shortages, and even the blockage of the Suez Canal.

OEMs have been conscious of the actuality that provide-side uncertainties could hinder sustainability-similar innovation adoption. As a result they commenced investing in new crops, manufacturing strains, and accelerated expending on electrical motor vehicles, batteries and substitute electricity.

Even with the the latest market choppiness, the need carries on to improve pretty speedy. Apart from startups, the try by incumbent corporations to shell out their way out of a post-recession recovery – by pouring revenue into underneath-invested infrastructure – and a rising determination to decarbonisation are fuelling a sturdy need in passenger motor vehicles not viewed in a long time.

For occasion, right after a gap of in excess of fifteen a long time, India’s largest carmaker Maruti Suzuki India introduced its approach to used INR eighteen,000 crore in a greenfield factory in Haryana with a peak yearly capacity of 10 lakh models

Similarly, the Indian wing of Fiat Chrysler Cars (FCA) confirmed its intention to shell out INR one,900 crore in increasing its product line to manufacture four new SUVs underneath the Jeep manufacturer.

Conclusion: In the earlier 12 months the mobility traders underscored the rising pace of transform as the COVID-19 crisis additional a new layer of complexity to an by now challenging scenario. This implies a short window of time for all mobility stakeholders, including incumbents, tech giants, and traders, to get ready their corporations for disruption. It is thus needed to fully grasp the place the market is going and why, and then shift your money appropriately.

(Disclaimer – The numbers could marginally vary from the actuals as these numbers represent only corporations survey by ETAuto)

Be aware: The next element of ‘Investments in time of COVID-19’ phase will surface on Wednesday. Stay Tuned!