New Delhi: Electrical Automobiles (EVs) in India could characterize Rs 500 billion prospect by 2025 with the existing and projected level of EV penetration, according to a report introduced by the monetary companies company Avendus Capital on Thursday.

Elaborating upon the EV prospect in India, Koushik Bhattacharyya, Director & Head – Industrials, Avendus Capital, discussed, “Over the earlier 10 years, the economics of the technology applied in this sector has enhanced significantly, and right now, EVs make economic sense across many use conditions. The inevitability of the changeover to EVs is approved by the world, nonetheless, the timeline for mass adoption is nonetheless a matter for debate. But we imagine that we are moving quickly in the direction of a mobility routine where EVs grow to be mainstream.”

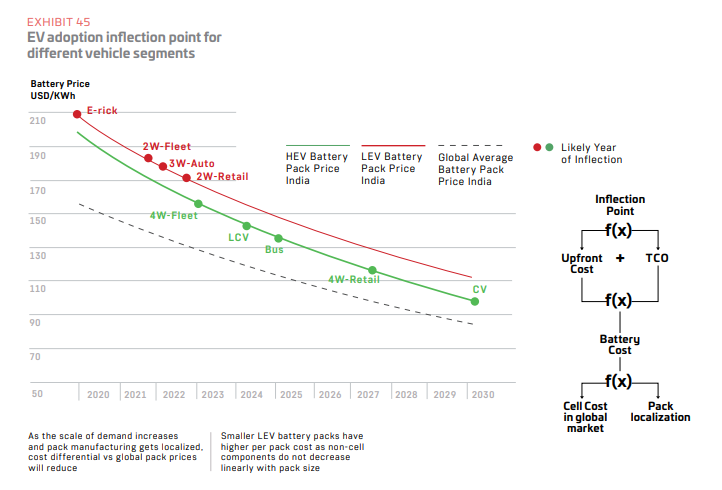

Inflection Position for EVs in India

In accordance to the report, the inflection point for EV adoption in India will be contingent not only on the Overall Price tag of Possession (TCO), but also on the upfront cost since retail users and personal prospective buyers are in particular sensitive to the upfront cost.

Resource: Avendus Capital

Resource: Avendus Capital

The premier driver for the upfront cost and as a result the TCO is the cost of the battery. As the cost of battery cuts down, the TCO of the EVs would grow to be lesser than the ICE equivalent versions and that would establish the inflection point for the fast adoption of EVs.

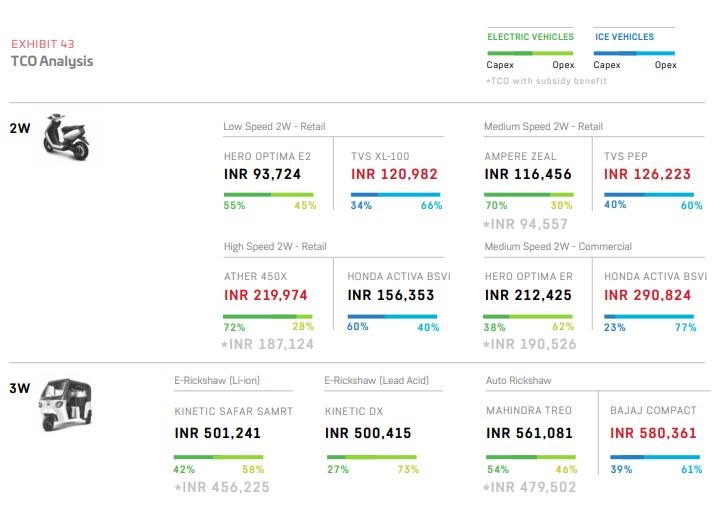

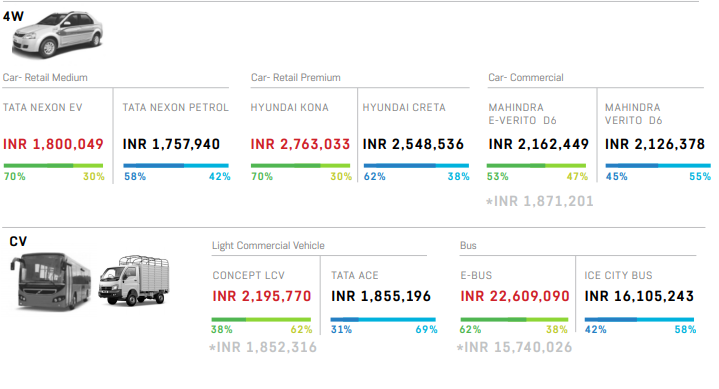

Bigger capital expenditure but reduced working costs for EVs also tends to make the asset utilization a vital factor. Industrial purposes – where cars operate for greater distances in excess of their lifetimes are already at or are pretty near to parity (thinking about the reward of subsidies in the situation of buses).

Resource: Avendus Capital

Resource: Avendus Capital

The report reveals that the Overall Price tag of Possession (TCO) in the situation of very low and medium-pace electric two-wheelers, e-autos /e-rickshaws and professional purposes of 4-wheelers, is already reduced than their counterpart ICE (Internal Combustion Motor) cars.

Resource: Avendus Capital

Resource: Avendus Capital

For large-pace two-wheeler EVs and other use conditions such as retail 4 wheelers, professional cars, the TCO will grow to be favourable as the battery charges drop further.

The report deep dives to appraise the effects of 4 vital things that will drive EV adoption in India in excess of the future 10 years – coverage, battery cost, charging infrastructure and offer chain localization.

The to start with two things are the most vital types and the future two are crucial situations to assistance a significant-scale adoption. As for each the assessment, the effects of these things on the general adoption has been considered to get there at a fair array of EV adoption by FY25.

EV adoption in numerous segments

Two and 3-wheelers will direct the electrification motion in India in the medium expression.

Avendus Capital expects nine p.c penetration by FY25 in the two-wheeler section. With the right macro surroundings, the number can further go up to 16 p.c. It is envisioned that this section will expand to be Rs a hundred and twenty billion by FY25.

E-rickshaws have emerged as a significant industry in India. A significant section of this industry is nonetheless unorganized and centered on direct-acid batteries. Having said that, this industry is envisioned to speedily shift to Li-ion and by FY25, with forty p.c of the e-rickshaws to be working on Li-ion batteries.

Ankit Singhal, Vice President – Industrials, Avendus Capital highlighted during the launch, “E-vehicle tends to make economic sense on a TCO foundation. We count on to see intensive motion in this area likely forward and ~20{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade} EV penetration in the E-Auto category by FY25.”

This section is envisioned to attain Rs forty billion by FY25. “In the medium expression, we count on the EV adoption in the 4-wheeler category to keep constrained to professional/ fleet purposes. The general penetration in the e-4W section is envisioned to be ~2{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade}. With the right macro surroundings, the number could go up to five{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade}. We count on this section to be Rs 100 bn by FY25”, mentioned Singhal.

On the professional automobile facet, E-buses are envisioned to direct the category. The regulatory force will drive this category, alternatively than TCO.

Speaking on the professional automobile section, Singhal included, “We count on this section to be Rs 60 billion by FY25. Light Industrial Automobiles (<3.5 tonnes) in the EV category also make TCO sense and we forecast about ~4{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade} EV adoption in this segment by FY25, translating into an Rs 15 billion market opportunity.”

Also Study: In electric motor vehicle industry, it is Tesla and a jumbled subject of also-rans

More Stories

Top 5 Family Cars to Lease with Bad Credit in the UK (2024)

Porsche Cayman R (987) | Spotted

Win a pair of tickets to Race Retro 2023