The EV boom is pay-dirt for factory machinery makers

DETROIT — The financial commitment surge by the two new and set up automakers in the electrical car market is a bonanza for factory tools makers that offer the really automatic “picks and shovels” for the prospectors in the EV gold hurry.

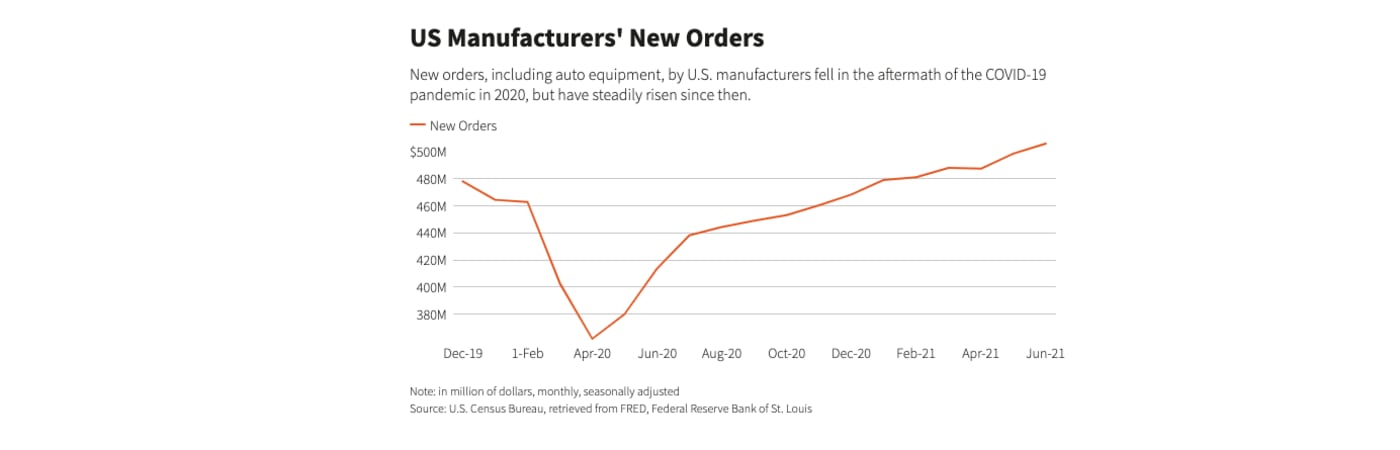

The fantastic moments for the makers of robots and other factory tools reflect the broader recovery in U.S. producing. Immediately after slipping article-COVID to $361.eight million in April 2020, new orders surged to nearly $506 million in June, in accordance to the U.S. Census Bureau.

New electrical car factories, funded by investors who have snapped up recently community shares in organizations these types of as EV commence-up Lucid are boosting demand from customers. “I am not certain it really is attained its climax nevertheless. You will find even now far more to go,” Andrew Lloyd, electromobility section leader at Stellantis-owned supplier Comau, explained in an interview. “Over the upcoming 18 to 24 months, there is likely to be a significant demand from customers coming our way.”

Expansion in the EV sector, propelled by the good results of Tesla, comes on prime of the ordinary function producing tools makers do to guidance output of gasoline-run motor vehicles.

Automakers will devote over $37 billion in North American vegetation from 2019 to 2025, with 15 of seventeen new vegetation in the United States, in accordance to LMC Automotive. Over seventy seven% of that paying out will be directed at SUV or EV projects.

Products companies are in no hurry to increase to their almost comprehensive capacity.

“You will find a all-natural position where by we will say ‘No'” to new small business, explained Comau’s Lloyd. For just a person region of a factory, like a paint store or a physique store, an automaker can easily expend $200 million to $three hundred million, sector officers explained.

‘Wild, Wild West’

“This sector is the Wild, Wild West suitable now,” John Kacsur, vice president of the automotive and tire section for Rockwell Automation, told Reuters. “There is a mad race to get these new EV variants to market.”Automakers have signed agreements for suppliers to build tools for 37 EVs among this calendar year and 2023 in North The usa, in accordance to sector specialist Laurie Harbour. That excludes all the function getting performed for gasoline-run motor vehicles.

“You will find even now a pipeline with projects from new EV makers,” explained Mathias Christen, a spokesman for Durr AG, which specializes in paint store tools and observed its EV small business surge about sixty five% last calendar year. “This is why we never see the peak nevertheless.”

Orders received by Kuka AG, a producing automation company owned by China’s Midea Team, rose 52% in the very first half of 2021 to just underneath one.nine billion euros ($two.23 billion) – the 2nd-optimum stage for a six-thirty day period time period in the firm’s background, due to strong demand from customers in North The usa and Asia.

“We ran out of capacity for any added function about a calendar year and a half back,” explained Mike LaRose, CEO of Kuka’s vehicle team in the Americas. “Everyone’s so fast paced, there is no flooring place.”

Kuka is creating electrical vans for Basic Motors at its plant in Michigan to enable meet early demand from customers prior to the No. one U.S. automaker replaces tools in its Ingersoll, Ontario, plant upcoming calendar year to deal with the typical function. Automakers and battery companies have to have to buy quite a few of the robots and other tools they have to have 18 months in advance, although Neil Dueweke, vice president of automotive at Fanuc Corp’s American functions, explained consumers want their tools quicker. He phone calls that the “Amazon impact” in the sector.

“We built a facility and have like five,000 robots on cabinets stacked 200 toes superior, nearly as far as the eye can see,” explained Dueweke, who famous Fanuc The usa set gross sales and market share records last calendar year.

COVID has also caused problems and delays for some automakers striving to tool up.

R.J. Scaringe, CEO of EV startup Rivian, explained in a letter to consumers last thirty day period that “all the things from facility development, to tools set up, to car part offer (specially semiconductors) has been impacted by the pandemic.”

Nonetheless, set up, prolonged-time consumers like GM and pieces supplier and contract manufacturer Magna explained they have not experienced delays in acquiring tools.

One more restricting variable for capacity has been the continuing lack of labor, sector officers explained.

To prevent the tension, startups like Fisker have turned to contract makers like Magna and Foxconn, whose shopping for power enables them to prevent shortages far more easily, CEO Henrik Fisker explained.

Escalating demand from customers, nevertheless, does not imply these tools makers are rushing to broaden capacity.

Possessing lived via downturns in which they ended up pressured to make cuts, tools suppliers want to make do with what they have, or in Comau’s case, just increase limited-term capacity, in accordance to Lloyd.

“Everybody’s afraid they are likely to get hammered,” explained Mike Tracy, a principal at consulting organization the Agile Team. “They just never have the reserve capacity they utilized to have.”

Connected Movie: