New Delhi: The earlier two a long time have of course been challenging for considerably of the economic climate. The onset of the next wave of the pandemic and looming threat of Omicron has afflicted the previously-having difficulties India’s journey to prosperity. With the slowdown that the economic climate had suffered, the country’s advancement charge had decelerated from 8.3% in 2016-17 to 4% in 2019-20.

With this history, when Finance Minister Nirmala Sitharaman stepped up on the podium to desk the Union Spending plan for 2022-23, it was the second spending plan amid the fear of COVID-19. Even the Financial Survey report introduced in Parliament a day before the spending plan mentioned the difficulties from the new variants of COVID-19 and the uncertainties in the world-wide economic system.

And, that is why potentially the operate-up to the Spending budget has been significantly less noisy in just the car industry this year than normal. However, that doesn’t suggest the sector had no anticipations and calls for from the finance minister.

It is no solution that the Indian auto business has confronted a significant slowdown simply because of COVID-19, world wide semiconductor shortage and unbridled commodity value improves.

The two the OEMs and the ingredient suppliers ended up hoping to get some immediate fiscal and coverage guidance in this year’s price range to fight the odds for resilience and survival. Electric motor vehicle phase was expected to be the emphasis spot. Offering an impetus for investments was also substantially wanted. Big bets were being also currently being positioned on taxation and infrastructure enhancement among a lot of many others that will support the business embark on a extensive-expression advancement path.

Whilst the Finance Minister’s spending plan speech on February 1, 2021 outlined a number of new provisions and enhanced investments to get the automobile business back again on track, some major chances were being also skipped. Also, the automobile field did not uncover any immediate point out in Union Finances 2022, which dismayed most of the stakeholders.

In this looking through checklist, we get a closer glimpse at some big takeaways of the Spending budget, which had a honest amount of hits and misses.

The hits:

Enhanced allocation of capex, high focus on for national highways, the proposal of an EV battery policy, tax incentives for startups, help for MSMEs, Emphasis on rural economy, and improve to community elements production, and are some of the important hits of the Union Budget 2022 from the automotive business standpoint.

Increased allocation of capex

An enhance in capex expenditure, and concentrate on infrastructure throughout the board, is a huge good. The federal government has announced a sharp soar of 35.4% in capex outlay to INR 7.5 lakh crore next yr as versus INR 5.54 lakh crore in the latest yr. This shift will present the significantly-essential impetus for the industrial car sector, primarily the M&HCV segment, which has witnessed sharp desire contraction about the previous two a long time.

High goal for nationwide highways

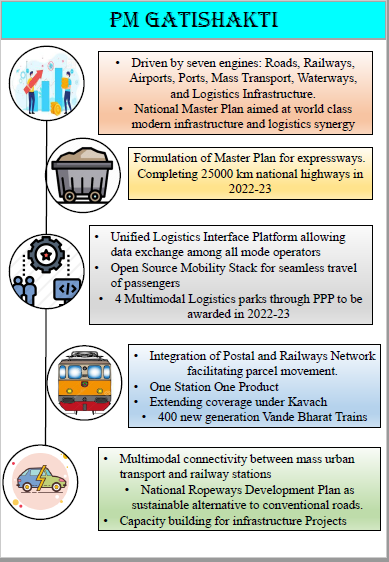

Growth of nationwide highways by 25,000 km beneath the Government’s Gati Shakti Programme, that encompasses thrust on seven diverse engines of growth, like streets, railways, and multi-modal logistics infrastructure, augurs very well for the desire for business automobiles, specifically Tipper Vans, development sector and tyre sector.

Gurus opine that allocation of INR 20,000 crore for road infrastructure jobs is probably to guide to a spillover desire for significant obligation vans and building machines and also enhance consumption of tyres.

Coming soon, EV battery plan

One of the landmark announcements of this Finances is the battery swapping coverage, which has the prospective to be a video game-changer in catalysing the migration to EVs. Further, the government’s transfer to generate special mobility zones for EV alongside with encouraging the personal sector’s involvement to develop sustainable and impressive enterprise products for battery and energy as a company will enhance the full EV ecosystem of the region.

In accordance to the professionals, commercial EV makers, particularly in electric two and three-wheelers, will income from this announcement and it is possible to insert self-confidence to the potential passenger EV prospective buyers also. The proposed battery-swapping plan will support generate criteria of interoperability thus building EVs additional available and reasonably priced.

Moreover, vehicle ingredient brands will also get a fillip as the proposal will motivate fresh new investments for indigenous battery makers.

Tax Incentives for startups

In the latest several years, the amount of mobility startups has improved rapidly and a lot more aid has turn into offered in all proportions. In a bid to give a improve to the country’s “growth drivers,” the finance minister on Tuesday announced an extension of the interval of incorporation of suitable startups by 1 much more 12 months for delivering tax incentives.

In her Funds speech, the Finance Minister also proposed capping surcharge on extensive-term capital gains arising on transfer of any kind of property at 15%.

“This move will give a boost to the startup group and along with my proposal on extending tax benefits to production organizations and startups reaffirms our commitment to Atma Nirbhar Bharat,” Nirmala Sitharaman said.

She also proposed the setting up of an skilled committee to keep an eye on mobilization of funds for startups through undertaking capitalists and private equities.

Aid for MSMEs

The MSME sector in the production room receives a strengthen with rolling out of the government’s Boosting and Accelerating MSME Effectiveness (RAMP) programme with an outlay of INR 6,000 crore over 5 several years. The objective of this programme is to increase credit rating and industry accessibility of MSMEs. The Finance Minister also stated that the Credit score Guarantee Have faith in for Micro and Little Enterprises (CGTMSE) scheme will be revamped with a needed infusion of money and will facilitate additional credit rating of INR 2 lakh crore for MSMEs and increase work.

MSMEs variety around 80% of community auto pieces and RAMP programmes will support deal with a lot of of their burning issues like delays in payment and obtain to credit history.

Emphasis on rural economy

The announcement on MSP payment of INR 2.37 lakh crore to farmers would persuade rural demand, which has remained sluggish soon after the 2nd wave of COVID-19. “The strategy is to boost rural income and empower rural use by placing funds immediately in the palms of the farmers,” Rajat Wahi, Associate, Deloitte India, stated.

According to score company ICRA, the Government’s ongoing aim on rural improvement and farmer welfare in the funds will uplift rural sentiments, and thus remains beneficial for the tractor and two-wheeler phase.

Improve to regional sections production

The Funds proposed rising import responsibility on sure parts (these as braking techniques, digital and engine elements like lights, windscreen wipers, turbo chargers) to 15% from 7.5% -10% before. This will unquestionably persuade nearby manufacturing of these components, which has been one more concentrate region of the federal government. Nevertheless, on the flip side there are some downsides as perfectly.

“In the interim it could increase the price tag of motor vehicles further more, which has been on an upward trend amid rising input price, and therefore hurt the over-all need,” Shruti Saboo, Associate Director, India Rankings and Research, claimed.

The major misses:

No rationalization of GST on automobiles, and no aid in private earnings tax are some of the big misses in the Price range 2022. A key shock is the prepare to impose an more differential excise duty of INR 2 a litre on unblended petrol and diesel.

No rationalization of GST on cars

The authorities still once again facet-lined the very long-standing desire of the automotive industry for lowering GST rates. All the automobile and related products are presently taxed at the concentrations of luxury products and slide in the bracket of best 28% slab. On top of that, cess is levied from 1% to 22% if the auto exceeds a selected overall body or engine dimension.

Greater GST premiums are making motor vehicles unaffordable for potential buyers primarily when amplified price ranges of uncooked components, successive fuel value hike, harder protection and emission guidelines have currently amplified the input value.

Together with this is the govt prepare to impose an supplemental differential excise obligation of INR 2 a litre on unblended petrol and diesel, auto fuel will undoubtedly turn out to be much more high-priced in days to appear. Consequently, revenue of the ailing commuter two-wheeler phase will are inclined to get another significant jolt in coming months.

Petrol rate spiked in almost all the months of 2021, at times even in each and every week of a thirty day period that shot up the ownership cost of 100-125 cc bikes and 110 cc scooters wherever in between 14% and 15% last year. Notably, this entry segment constitutes 75% of the two-wheeler product sales in the domestic market.

No reduction in personal profits tax

Person taxpayers and salaried middle course are extremely upset as the finance minister did not make any main announcement to present any reduction to this section. From the vehicle marketplace stage of watch, they are most likely the prime people in the regional marketplace, as a result neglecting them in the pandemic-induced current market will even further hold off the revival potential clients.

In conclusion, the budget is unlikely to straight away induce a intake revival within just the car sector nevertheless it is curated to generate liquidity for consumers in the extended term in each rural and city regions. As for every Vikas Bajaj, president of the Affiliation of Indian Forging Business (AIFI), “Apart from encouraging EVs (electric powered vehicles) by creating a battery-swapping tactic to conquer EV charging infrastructure, I consider there just isn’t considerably in the funds to guidance the car sector as was predicted.”

Also View:

More Stories

2023 Toyota Prius arrives with more power, efficiency, style

Tesla Stock Hits New Low, Wipes Out About $600 Billion in Value in Two Months

Grech RV’s Terreno: Ready For Anything