Carmakers face $61 billion sales hit from pandemic chip shortage, Auto News, ET Auto

By Katrina Nicholas, Keith Naughton, Gabrielle Coppola and Debby Wu

When the Tohoku earthquake and tsunami-ravaged Japan in 2011, ocean water flooded factories owned by Renesas Electronics Corp. Production at the swamped amenities floor to a halt—a significant hit for Renesas, of training course, but also a devastating blow to the Japanese car or truck market, which depended on Renesas for semiconductors.

Missing chips for anything from transmissions to touchscreens, Honda, Nissan, and Toyota ended up pressured to shut down or slow output for months. As the perils of just-in-time production and the risks of relying on a single supplier for important parts turned noticeable, automakers vowed to steer obvious of comparable snafus in the future.

Nonetheless a 10 years afterwards, the world-wide auto market finds by itself in an virtually equivalent predicament. The catalyst for the breakdown this time is a slower-moving natural disaster: the coronavirus pandemic, which has disrupted the provide chain for makers of the electronics that are the brains of modern autos. That left automakers—which have extended eschewed retaining high-priced inventories of parts—scrambling to protected all those parts when profits rebounded.

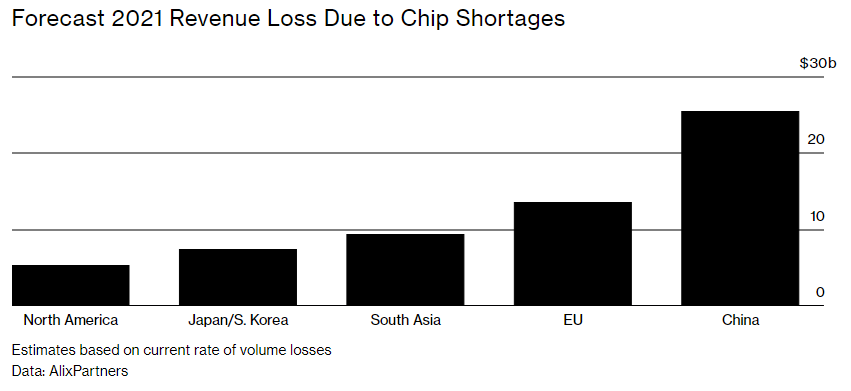

The lack could direct to a lot more than $14 billion in shed revenue in the initial quarter and some $61 billion for the 12 months, advisory business AlixPartners predicts.

The market is “wedded to ‘lean production,’ ” suggests Tor Hough, founder of Elm Analytics, an market consultant in close proximity to Detroit. “They have gotten in this method of just managing for upcoming 7 days or upcoming thirty day period.”

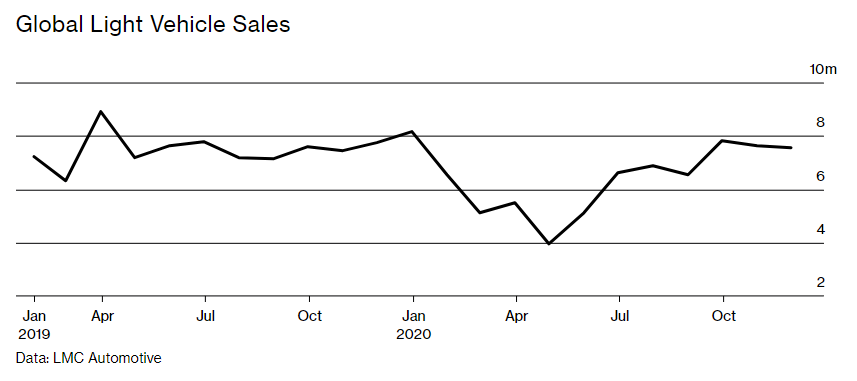

The pandemic pressured the broadest shutdown of motor vehicle vegetation considering that Environment War II, and lockdowns shut showrooms all over the world, sending profits into a funk. But previous summertime, just after the limitations ended up eased and factories reopened, demand bounced back again faster than predicted. Spurred by rock-bottom curiosity costs and fears of crowding into subways or buses, people throughout the world snapped up SUVs, sedans, and pickups.

The pandemic pressured the broadest shutdown of motor vehicle vegetation considering that Environment War II, and lockdowns shut showrooms all over the world, sending profits into a funk. But previous summertime, just after the limitations ended up eased and factories reopened, demand bounced back again faster than predicted. Spurred by rock-bottom curiosity costs and fears of crowding into subways or buses, people throughout the world snapped up SUVs, sedans, and pickups.

Cars these days are in several respects pcs on wheels, with electronics accounting for about 40{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade} of a vehicle’s worth. By the time auto sections suppliers understood they ended up managing small on the dozens of microprocessors necessary for every car or truck, chipmakers ended up slammed earning semiconductors for the cellphones, video game consoles, and pcs that housebound shoppers ended up shopping for like mad.

The issues have been exacerbated by the outsize electrical power of a single organization: Taiwan Semiconductor Producing Co., which accounted for fifty six{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade} of world-wide chip production revenue in the fourth quarter of 2020, according to researcher TrendForce.

Automakers hardly ever obtain directly from TSMC, as a substitute purchasing most of their electronics from suppliers that frequently outsource the structure and production of chips to automotive-targeted stores these as NXP Semiconductors NV and Infineon Technologies AG. Those companies make some sections in-residence, but they retain the services of TSMC to handle a great deal of their generation.

When the auto industry’s requires are monumental, they’re dwarfed by all those of customer-electronics giants these as Apple, Samsung, and Sony, which are “ready to fork out a lot more for chips to guarantee their gadgets get to current market on time,” suggests Jeff Pu, an analyst at GF Securities Co. “Carmakers are fewer inclined to do so.”

The issues begun to bubble up a couple of days before Xmas, when Volkswagen AG claimed it was bracing for generation disruptions since of a semiconductor lack. Component makers Robert Bosch and Continental AG came upcoming, indicating they risked delays, then Nissan Motor Co. confirmed that a dearth of chips would force it to scale back again production of its Be aware hatchback. Right after that, the announcements rolled in rapidly.

Fiat Chrysler idled vegetation in Canada and Mexico Daimler claimed it was impacted by the bottleneck Honda slashed output by about 4,000 autos at a facility in Japan Ford shut a person SUV manufacturing unit in Kentucky for a 7 days and one more in Germany for a thirty day period. Researcher IHS Markit suggests 628,000 cars—3{0764260a27b4b31ca71a8adf79c3ae299a61e6f062052eee3f0df84ce9b30ade} of world-wide production—will be knocked off in the initial quarter by yourself.

Nonetheless for all the ache, automakers are hesitant to improve their lean production tactics, since the cost savings they provide outweigh even the expenses of disruptions like all those they encounter this 12 months. Carmaking is an inherently reduced-margin enterprise, and producers are loath to create up expensive stock since to convert a gain, the flow of sections into a manufacturing unit requires to match the stream of vehicles coming out the other aspect. So it tends to make small sense to approach the full procedure all over a worst-situation scenario that comes only when a 10 years, suggests Kevin Tynan, an analyst with Bloomberg Intelligence. “It’s like driving a big 4×4 SUV 12 months-spherical ready for possibly 3 or four snowstorms,” he suggests.

When the two sides publicly say they’re operating with each other to take care of the challenge, in non-public every points a finger at the other. The chipmakers insist the car or truck industry’s obsession with reduced inventories is to blame. Vehicle and sections producers counter that semiconductor makers have favored customer-electronics companies since all those gadgets offer the bulk of their profits—an allegation chipmakers deny.

Regardless of who’s at fault, couple of count on the bottleneck to obvious before the summertime, and some say it will previous into the drop. It’s not simple for chipmakers to add capability, since most factories are at the moment managing total-steam and new vegetation generally price billions of bucks and consider years to create. “It’s seriously likely to have an effect through the initial fifty percent,” suggests Matt Blunt, president of the American Automotive Plan Council, a lobbying group for Detroit automakers. “And the lengthier it normally takes to resolve, the a lot more it will bleed into the 3rd quarter.”